Home »

Understanding Accounts Receivable

These organizations require compliance with higher security standards and need […]

These organizations require compliance with higher security standards and need to protect sensitive information against sophisticated threats. GCC High is reserved for the Defense Industrial Base (DIB), DoD contractors, and Federal Agencies. Such an allowance offsets the accounts receivable, meaning you subtract the allowance of doubtful accounts from accounts receivable. This is done to calculate the net amount of accounts receivable anticipated to be collected by your business. According to the above example, a customer on an average takes 65 days to pay for the goods purchased on credit for Ace Paper Mills.

Say, you record a Prepaid Rent of $500 at the end of every month, the adjusting entry would be as follows. A general ledger helps you to know the overall profitability and financial health of your business. In addition to this, the information contained in general ledgers help you to run any audits smoothly. In other words, you’ll get a clear view of your business’s capacity to generate profits and the resources you have available in order to meet outsider’s claims.

These enhanced standards make this option suitable for handling highly sensitive information and ensuring compliance with strict regulatory requirements. This isolation ensures that only U.S. citizens with specific clearances can access the data, providing an additional layer of security. These compliance standards ensure that GCC can handle how to create a discount pricing strategy for bigger profits controlled unclassified information (CUI) and other sensitive government data securely.

Microsoft 365 GCC High and DoD

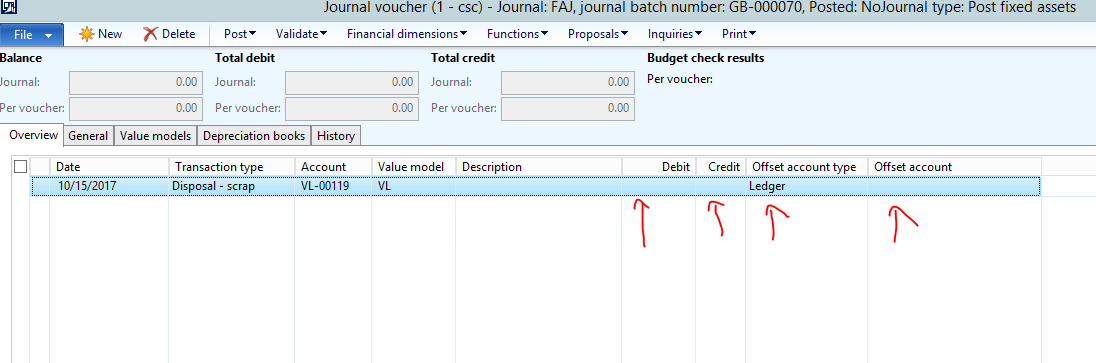

The April 6 transaction removes the accounts receivable from your balance sheet and records the cash payment. To further understand the difference in these accounts, you need an overview of a company’s balance sheet. A general ledger contains information related to different accounts, providing information that helps you in preparing your business’ financial statements, including income statements and balance sheets. The accounts receivable aging report breaks down your outstanding invoices by how old they are. To create this report, you’ll group your accounts receivable balances by the age of each invoice. Net credit sales means that all returned items are removed from the sales total.

Security and Compliance Features

Both options provide robust security, but GCC High offers additional layers of protection to meet more stringent compliance requirements. While GCC is suitable for handling CUI under FedRAMP Moderate controls, GCC High extends this to FedRAMP High, DFARS, and ITAR, making it indispensable for defense contractors and other highly regulated industries. ” Understanding your compliance needs is crucial when comparing GCC High vs. GCC. The distinctions between Commercial, GCC, and finance panel weighs uses for arpa funding GCC High Microsoft 365 cloud computing environments are significant and directly impact security, regulatory adherence, and data sovereignty.

Set up parent and sub-customers to group your open receivables

This means the bad debts expense account gets debited and the allowance for doubtful accounts gets credited whenever you provide for bad debts. In other words, you provide goods and services to your customers instantly, but you receive payments for such goods generally accepted accounting principles gaap and services after a few days. Customers at a grocery store or restaurant pay right away with cash or a card.

However, with online accounting software like QuickBooks, general ledger reconciliation has become a lot easier. Unlike journal where transactions are recorded in chronological order as they occur, you record transactions in the ledger by classifying them under various account heads to which they relate. A purchases ledger, or creditors ledger, records all transactions relating to purchases that a business entity makes.

- The customers who may not pay for the goods sold to them are then recorded as bad debts in the books of accounts.

- It has the most features and tools, nearly global availability, and the lowest prices.

- This is done by comparing balances that appear on the ledger accounts to those on the original documents, such as bank statements, invoices, credit card statements, purchase receipts, etc.

- This is done because you do not want to understate any expenses in your financial statements for the next 12 months.

As a seller, you must be careful when extending trade credit to your customers, as you run the risk of non-payments attached to accounts receivables. The customers who may not pay for the goods sold to them are then recorded as bad debts in the books of accounts. Accounts receivable is deemed an asset because it is an outstanding balance that you are yet to receive from your customers. Accordingly, this unpaid balance in the accounts receivable account forms part of the current assets section on your company’s balance sheet. Microsoft 365 Government Community Cloud (GCC) and GCC High have emerged as pivotal platforms for government agencies and organizations operating in regulated industries. These dedicated cloud environments provide a robust array of productivity and collaboration tools specifically designed to satisfy the rigorous security and compliance demands of the public sector.